Disclaimer: this blog post is about my understanding of the UK’s smart meter data ecosystem and contains some opinions about how it might evolve. These do not in any way reflect those of Energy Sparks of which I am a trustee.

This blog post is an introduction to the UK’s smart meter data ecosystem. It sketches out some of the key pieces of data infrastructure with some observations around how the overall ecosystem is evolving.

It’s a large, complex system so this post will only touch on the main elements. Pointers to more detail are included along the way.

If you want a quick reference, with more diagrams then this UK government document, “Smart Meters, Smart Data, Smart Growth” is a good start.

Smart meter data infrastructure

Smart meters and meter readings

Data about your home or business energy usage was collected by someone coming to read the actual numbers displayed on the front of your meter. And in some cases that’s still how the data is collected. It’s just that today you might be entering those readings into a mobile or web application provided by your supplier. In between those readings, your supplier will be estimating your usage.

This situation improved with the introduction of AMR (“Automated Meter Reading”) meters which can connect via radio to an energy supplier. The supplier can then read your meter automatically, to get basic information on your usage. After receiving a request the meter can broadcast the data via radio signal. These meters are often only installed in commercial properties.

Smart meters are a step up from AMR meters. They connect via a Wide Area Network (WAN) rather than radio, support two way communications and provide more detailed data collection. This means that when you have a smart meter your energy supplier can send messages to the meter, as well as taking readings from it. These messages can include updated tariffs (e.g. as you switch supplier or if you are on a dynamic tariff) or a notification to say you’ve topped up your meter, etc.

The improved connectivity and functionality means that readings can be collected more frequently and are much more detailed. Half hourly usage data is the standard. A smart meter can typically store around 13 months of half-hourly usage data.

The first generation of smart meters are known as SMETS-1 meters. The latest meters are SMETS-2.

Meter identifiers and registers

Meters have unique identifiers.

For gas meters the identifiers are called MPRNs. I believe these are allocated in blocks to gas providers to be assigned to meters as they are installed.

For energy meters, these identifiers are called MPANs. Electricity meters also have a serial number. I believe MPRNs are assigned by the individual regional electricity network operators and that this information is used to populate a national database of installed meters.

From a consumer point of view, services like Find My Supplier will allow you to find your MPRN and energy suppliers.

Connectivity and devices in the home

If you have a smart meter installed then your meters might talk directly to the WAN, or access it via a separate controller that provides the necessary connectivity.

But within the home, devices will talk to each other using Zigbee, which is a low power internet of things protocol. Together they form what is often referred to as the “Home Area Network” (HAN).

It’s via the home network that your “In Home Display” (IHD) can show your current and historical energy usage as it can connect to the meter and access the data it stores. Your electricity usage is broadcast to connected devices every 10 seconds, while gas usage is broadcast every 30 minutes.

You IHD can show your energy consumption in various ways, including how much it is costing you. This relies on your energy supplier sending your latest tariff information to your meter.

As this article by Bulb highlights, the provision of an IHD and its basic features is required by law. Research showed that IHDs were more accessible and nudged people towards being more conscious of their energy usage. The high-frequency updates from the meter to connected devices makes it easier, for example, for you to identify which devices or uses contribute most to your bill.

Your energy supplier might provide other apps and services that provide you with insights, via the data collected via the WAN.

But you can also connect other devices into the home network provided by your smart meter (or data controller). One example is a newer category of IHD called a “Consumer Access Device” (CAD), e.g. the Glow.

These devices connect via Zigbee to your meter and via Wifi to a third-party service, where it will send your meter readings. For the Glow device, that service is operated by Hildebrand.

These third party services can then provide you with access to your energy usage data via mobile or web applications. Or even via API. Otherwise as a consumer you need to access data via whatever methods your energy supplier supports.

The smart meter network infrastructure

SMETS-1 meters connected to a variety of different networks. This meant that if you switched suppliers then they frequently couldn’t access your meter because it was on a different network. So meters needed to be replaced. And, even if they were on the same network, then differences in technical infrastructure meant the meters might lose functionality..

SMETS-2 meters don’t have this issue as they all connect via a shared Wide Area Network (WAN). There are two of these covering the north and south of the country.

While SMETS-2 meters are better than previous models, they still have all of the issues of any Internet of Things device: problems with connectivity in rural areas, need for power, varied performance based on manufacturer, etc.

Some SMETS-1 meters are also now being connected to the WAN.

Who operates the infrastructure?

The Data Communication Company is a state-licensed monopoly that operates the entire UK smart meter network infrastructure. It’s a wholly-owned subsidiary of Capita. Their current licence runs until 2025.

DCC subcontracted provision of the WAN to support connectivity of smart meters to two regional providers.In the North of England and Scotland that provider is Arqiva. In the rest of England and Wales it is Telefonica UK (who own O2).

All of the messages that go to and from the meters via the WAN go via DCC’s technical infrastructure.

The network has been designed to be secure. As a key piece of national infrastructure, that’s a basic requirement. Here’s a useful overview of how the security was designed, including some notes on trust and threat modelling.

Part of the design of the system is that there is no central database of meter readings or customer information. It’s all just messages between the suppliers and the meters. However, as they describe in a recently published report, the DCC do apparently have some databases of the “system data” generated by the network. This is the metadata about individual meters and the messages sent to them. The DCC calls this “system data”.

The smart meter roll-out

It’s mandatory for smart meters to now be installed in domestic and smaller commercial properties in the UK. Companies can install SMETS-1 or SMETS-2 meters, but the rules were changed recently so only newer meters count towards their individual targets. And energy companies can get fined if they don’t install them quickly enough.

Consumers are being encouraged to have smart meters fitted in existing homes, as meters are replaced, to provide them with more information on their usage and access to better tariffs such as those that offer dynamic time of day pricing., etc.

But there are also concerns around privacy and fears of energy supplies being remotely disconnected, which are making people reluctant to switch when given the choice. Trust is clearly an important part of achieving a successful rollout.

Ofgem have a handy guide to consumer rights relating to smart meters. Which? have an article about whether you have to accept a smart meter, and Energy UK and Citizens Advice have a 1 page “data guide” that provides the key facts.

But smart meters aren’t being uniformly rolled out. For example they are not mandated for all commercial (non-domestic) properties.

At the time of writing there are over 10 million smart meters connected via the DCC, with 70% of those being SMET-2 meters. The Elexon dashboard for smart electricity meters estimates that the rollout of electricity meters is roughly 44% complete. There are also some official statistics about the rollout.

The future will hold much more fine-grained data about energy usage across the homes and businesses in the UK. But in the short-term there’s likely to be a continued mix of different meter types (dumb, AMR and smart) meaning that domestic and non-domestic usage will have differences in the quality and coverage of data due to differences in how smart meters are being rolled out.

Smart meters will give consumers greater choice in tariffs because the infrastructure can better deal with dynamic pricing. It will help to shift to a greener more efficient energy network because there is better data to help manage the network.

Access to the data infrastructure

Access to and use of the smart meter infrastructure is governed by the Smart Energy Code. Section I covers privacy.

The code sets out the roles and responsibilities of the various actors who have access to the network. That includes the infrastructure operators (e.g. the organisations looking after the power lines and cables) as well as the energy companies (e.g. those who are generating the energy) and the energy suppliers (e.g. the organisations selling you the energy).

There is a public list of all of the organisations in each category and a summary of their licensing conditions that apply to smart meters.

The focus of the code is on those core actors. But there is an additional category of “Other Providers”. This is basically a miscellaneous group of other organisations not directly involved in provision of energy as a utility, but may have or require access to the data infrastructure.

These other providers include organisations that:

- provide technology to energy companies who need to be able to design, test and build software against the smart meter network

- that offer services like switching and product recommendations

- that access the network on behalf of consumers allowing them to directly access usage data in the home using devices, e.g. Hildebrand and its Glow device

- provide other additional third-party services. This includes companies like Hildebrand and N3RGY that are providing value-added APIs over the core network

To be authorised to access the network you need to go through a number of stages, including an audit to confirm that you have the right security in place. This can take a long time to complete. Documentation suggests this might take upwards of 6 months.

There are also substantial annual costs for access to the network. This helps to make the infrastructure sustainable, with all users contributing to it.

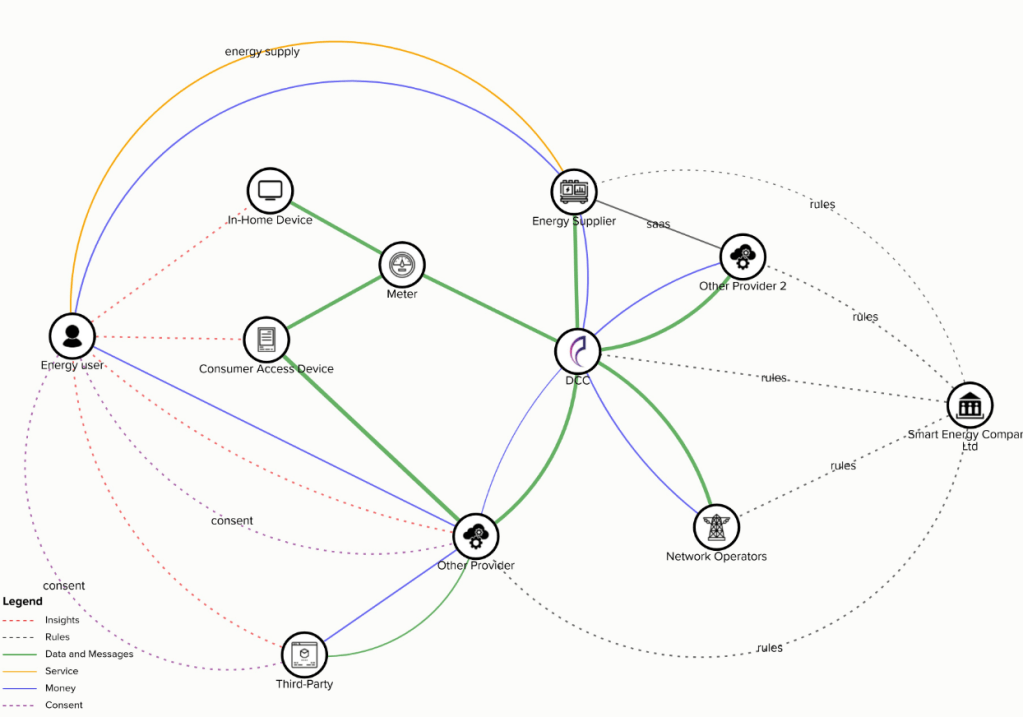

Data ecosystem map

As a summary, here’s the key points:

- your in-home devices send and receive messages and data via a the smart meter or controller installed in your home, or business property

- your in-home device might also be sending your data to other services, with your consent

- messages to and from your meter are sent via a secure network operated by the DCC

- the DCC provide APIs that allow authorised organisations to send and receive messages from that data infrastructure

- the DCC doesn’t store any of the meter readings, but do collect metadata about the traffic over that network

- organisation who have access to the infrastructure may store and use the data they can access, but generally need consent from users for detailed meter data

- the level and type of access, e.g. what messages can be sent and received, may differ across organisations

- your energy suppliers uses the data they retrieve from the DCC to generate your bills, provide you with services, optimise the system, etc

- the UK government has licensed the DCC to operate that national data infrastructure, with Ofgem regulating the system

At a high-level, the UK smart meter system is like a big federated database: the individual meters store and submit data, with access to that database being governed by the DCC. The authorised users of that network build and maintain their own local caches of data as required to support their businesses and customers.

The evolving ecosystem

This is a big complex piece of national data infrastructure. This makes it interesting to unpick as an example of real-world decisions around the design and governance of data access.

It’s also interesting as the ecosystem is evolving.

Changing role of the DCC

The DCC have recently published a paper called “Data for Good” which sets out their intention to a “system data exchange” (you should read that as “system data” exchange). This means providing access to the data they hold about meters and the messages sent to and from them. (There’s a list of these message types in a SEC code appendix).

The paper suggests that increased access to that data could be used in a variety of beneficial ways. This includes helping people in fuel poverty, or improving management of the energy network.

Encouragingly the paper talks about open and free access to data, which seems reasonable if data is suitably aggregated and anonymised. However the language is qualified in many places. DCC will presumably be incentivised by the existing ecosystem to reduce its costs and find other revenue sources. And their 5 year business development plan makes it clear that they see data services as a new revenue stream.

So time will tell.

The DCC is also required to improve efficiency and costs for operating the network to reduce burden on the organisations paying to use the infrastructure. This includes extending use of the network into other areas. For example to water meters or remote healthcare (see note at end of page 13).

Any changes to what data is provided, or how the network is used will require changes to the licence and some negotiation with Ofgem. As the licence is due to be renewed in 2025, then this might be laying groundwork for a revised licence to operate.

New intermediaries

In addition to a potentially changing role for the DCC, the other area in which the ecosystem is growing is via “Other Providers” that are becoming data intermediaries.

The infrastructure and financial costs of meeting the technical, security and audit requirements required for direct access to the DCC network creates a high barrier for third-parties wanting to provide additional services that use the data.

The DCC APIs and messaging infrastructure are also difficult to work with meaning that integration costs can be high. The DCC “Data for Good” report notes that direct integration “…is recognised to be challenging and resource intensive“.

There are a small but growing number of organisations, including Hildebrand, N3RGY, Smart Pear and Utiligroup who see an opportunity both to lower this barrier by providing value-added services over the DCC infrastructure. For example, simple JSON based APIs that simplify access to meter data.

Coupled with access to sandbox environments to support prototyping, this provides a simpler and cheaper API with which to integrate. Security remains important but the threat profiles and risks are different as API users have no direct access to the underlying infrastructure and only read-only access to data.

To comply with the governance of the existing system, the downstream user still needs to ensure they have appropriate consent to access data. And they need to be ready to provide evidence if the intermediary is audited.

The APIs offered by these new intermediaries are commercial services: the businesses are looking to do more than just cover their costs and will be hoping to generate significant margin through what is basically a reseller model.

It’s worth noting that access to AMR meter data is also typically via commercial services, at least for non-domestic meters. The price per meter for data from smart meters currently seems lower, perhaps because it’s relying on a more standard, shared underlying data infrastructure.

As the number of smart meters grows I expect access to a cheaper and more modern API layer will become increasingly interesting for a range of existing and new products and services.

Lessons from Open Banking

From my perspective the major barrier to more innovative use of smart meter data is the existing data infrastructure. The DCC obviously recognises the difficulty of integration and other organisations are seeing potential for new revenue streams by becoming data intermediaries.

And needless to say, all of these new intermediaries have their own business models and bespoke APIs. Ultimately, while they may end up competing in different sectors or markets, or over quality of service, they’re all relying on the same underlying data and infrastructure.

In the finance sector, Open Banking has already demonstrated that a standardised set of APIs, licensing and approach to managing access and consent can help to drive innovation in a way that is good for consumers.

There are clear parallels to be drawn between Open Banking, which increased access to banking data, and how access to smart meter data might be increased. It’s a very similar type of data: highly personal, transactional records. And can be used in very similar ways, e.g. account switching.

The key difference is that there’s no single source of banking transactions, so regulation was required to ensure that all the major banks adopted the standard. Smart meter data is already flowing through a single state-licensed monopoly.

Perhaps if the role of the DCC is changing, then they could also provide a simpler standardised API to access the data? Ofgem and DCC could work with the market to define this API as happened with Open Banking. And by reducing the number of intermediaries it may help to increase trust in how data is being accessed, used and shared?

If there is a reluctance to extend DCC’s role in this direction then an alternative step would be to recognise the role and existence of these new types of intermediary with the Smart Energy Code. That would allow their license to use the network to include agreement to offer a common, core standard API, common data licensing terms and approach for collection and management of consent. Again, Ofgem, DCC and others could work with the market to define that API.

For me either of these approaches are the most obvious ways to carry the lessons and models from Open Banking into the energy sector. There are clearly many more aspects of the energy data ecosystem that might benefit from improved access to data, which is where initiatives like Icebreaker One are focused. But starting with what will become a fundamental part of the national data infrastructure seems like an obvious first step to me.

The other angle that Open Banking tackled was creating better access to data about banking products. The energy sector needs this too, as there’s no easy way to access data on energy supplier tariffs and products.